In Ukraine, control over currency operations has been strengthened.

The Cabinet of Ministers has expanded the powers of the State Tax Service regarding currency supervision.

The provision on the State Tax Service now states that it can receive information on the taxpayer's compliance with the limits set by the National Bank for the deadlines for settlements on all foreign economic operations – both export and import, and not only on the non-receipt of foreign currency earnings within the established deadlines (as before), reports Liga.

This authority is implemented in accordance with the law "On Banks and Banking Activities".

In addition, the State Tax Service has been given the authority to carry out compliance, that is, control over the observance of legislation with a main focus not only on identifying violations but also on preventing them.

In July 2024, the National Bank increased the limit for settlement deadlines on agricultural export operations from 90 to 120 calendar days. For other internal export goods, the settlement deadlines remain at 180 days.

Read also

- The Ministry of Defense explained whether foreigners or stateless persons can obtain combatant status in the Armed Forces of Ukraine

- Trump demands 5% of GDP for defense: how NATO plans to meet this unprecedented requirement

- Russians are trying to establish fire control over logistics routes in Zaporizhzhia

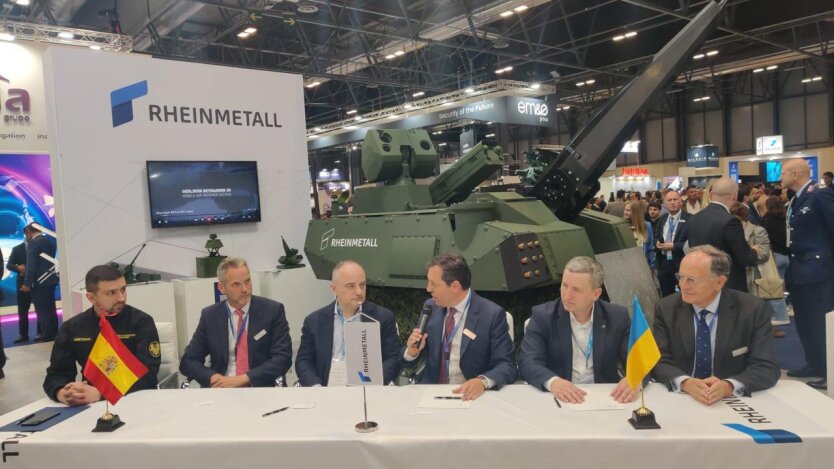

- Strategic Partnership: Ukroboronprom and Rheinmetall Expand Arms Production in Ukraine

- Around 200 vessels and dozens of companies: EU tightens the sanctions loop around Russia

- The enemy cannot accumulate forces near the northern borders of Ukraine - OTU 'Siversk'