The oil market reacted to Trump's tariff plans.

Oil prices rose due to the threat of tariffs on imported steel and aluminum by U.S. President Donald Trump. Investors are assessing the possibility of reduced global economic growth and decreased demand for energy resources.

The price of Brent crude rose by 51 cents to $75.17 per barrel, while the price of American oil WTI increased by 45 cents to $71.45 per barrel, reports Economic Truth citing data from Reuters.

Last week, the market experienced its third price drop due to fears of a trade war.

Trump announced his intention to impose a 25% tariff on all imported steel and aluminum, marking a new step in his trade policy.

Last week, the U.S. president already imposed tariffs on imports from Canada, Mexico, and China, but later temporarily suspended them for neighboring countries.

Analyst Tony Sycamore from IG noted that investors currently aren't reacting strongly to the threat of steel and aluminum tariffs, as they are already accustomed to such headlines and consider the likelihood of cancellation or escalation of tariffs to be roughly equal.

He added that investors are starting to understand that negative reactions to every piece of news are not the best strategy.

Additionally, China's tariffs on American goods still remain in effect, but there are currently no signs of progress in negotiations between China and the U.S.

Traders engaged in oil and gas trading are trying to rid themselves of tariffs on American oil and gas imported from the U.S.

Read also

- Verification of military accounting documents - who has the right to this

- Appointments in the government and Trump's statements about Putin - Morning.LIVE broadcast

- Attack by the Russian Federation on an enterprise in Kryvyi Rih - one injured

- Fico is ready to unblock the 18th package of EU sanctions, but there's a condition

- Will US Weapons Help End the War — Opinions of Odessa Residents

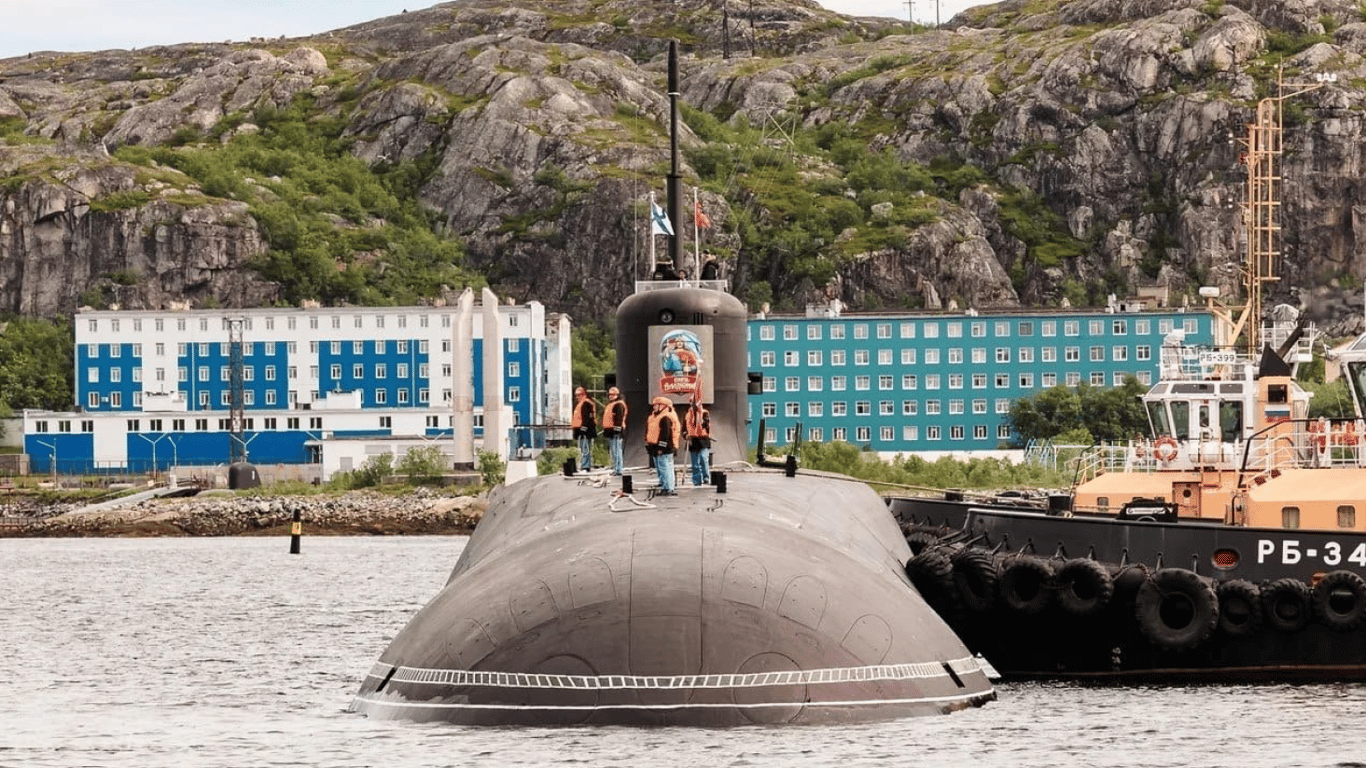

- The Kremlin is building new nuclear facilities - where they are located