Shares of the Indian giant Adani collapsed due to suspicions of circumventing sanctions against Iran.

The well-known Indian conglomerate Adani Group is facing scrutiny over accusations of possible collaboration with Iran, which is under sanctions. Shares of many of the company's subsidiaries have plummeted, particularly those of Adani Ports & Special Economic Zone Ltd., which lost 2.7%. An investigation by The Wall Street Journal revealed that some tankers associated with Adani may be attempting to evade sanctions, which is currently being reviewed by U.S. authorities.

The investigation by The Wall Street Journal indicated that several tankers frequently traveling between the Mundra port owned by Adani and the Persian Gulf may be attempting to evade sanctions. U.S. authorities are investigating these vessels, which had previously transported cargo for Adani Enterprises.

Adani Enterprises denies the allegations of collaboration with Iran and emphasizes the baselessness of these accusations. However, such allegations have only exacerbated problems for the conglomerate, which has already faced management issues and corruption scandals. This episode may impact international markets due to increased sanctions against Iran.

Negative impact on international markets

The publication of the article in The Wall Street Journal led to a sharp decline in Adani Group's shares due to potential dealings with Iran, which could have serious consequences for the company in international markets.

Read also

- In Ukraine, the rules for crossing the border have changed: how to exit after June 1

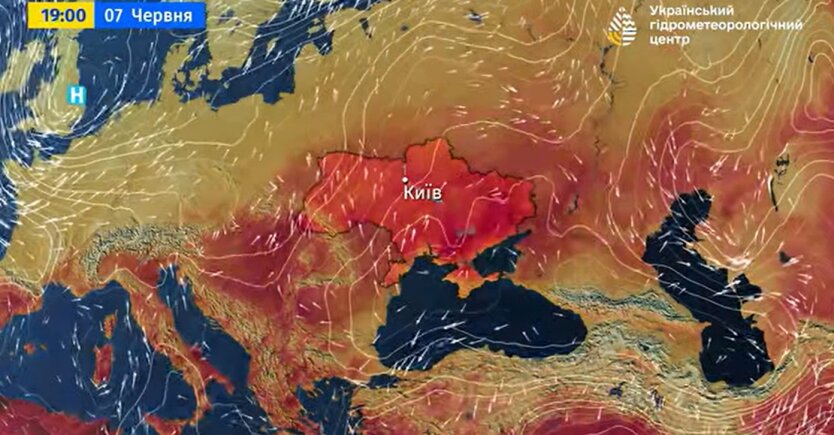

- After the hellish heat, a sharp cold snap will come: regions where the weather will change have been named

- Banks will appear at post offices and supermarkets in Ukraine: NBU explained the principles of operation

- Pensions and Subsidies: The Pension Fund of Ukraine Reported Record Financial Inflows

- The Atlantic: Operation 'Spider' Angers Trump and Casts Doubt on Military Aid to Ukraine

- Cocoa Prices Split Swiss Chocolate Market